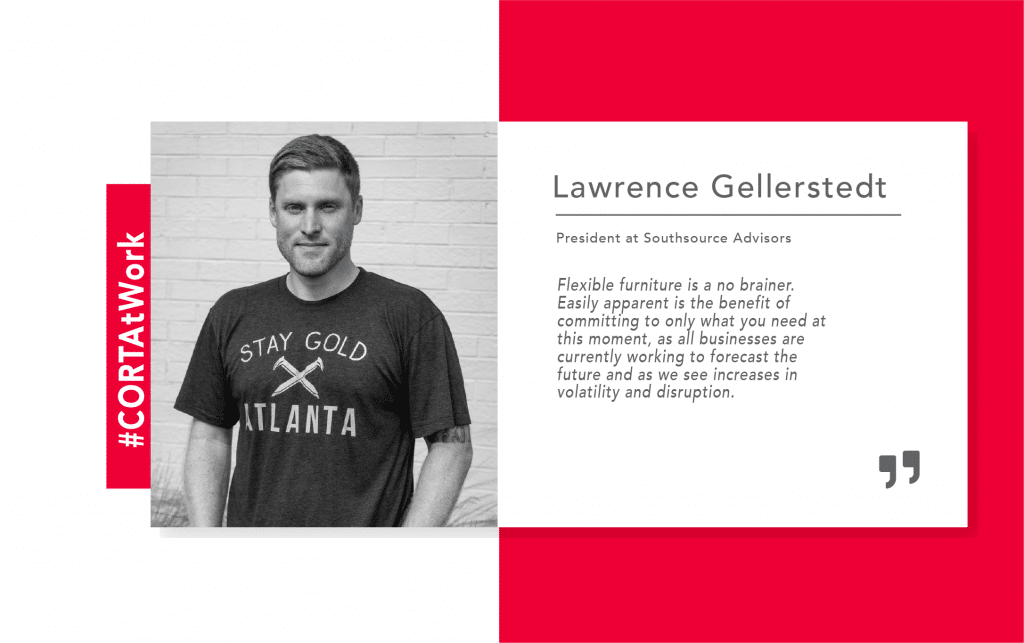

Melanie Jones on the workplace team at CORT had the opportunity to ask Lawrence Gellerstedt about his commercial real estate journey from leadership at Cushman and Wakefield, to interesting times at WeWork and now with his own, Atlanta based firm, Southsource Advisors.

Melanie Jones: You and I met about five years ago. At that time, you often worked out of the infamous Atlanta Tech Village as an innovator for Cushman & Wakefield. Sometimes you wore a t-shirt. You were razor-sharp focused on supporting technology firms in the Southeast with their office leasing needs. In my eyes, you were so unique, and I still love that about you!

I remember being so impressed with your unselfish and authentic approach—a trailblazer. You told me, “My goal is to understand my client’s objectives and their growth trajectory and then develop strategies around that with a short-term and long-term roadmap”. In my opinion, the unselfish part was your desire to truly help no matter what that meant for you from a compensation perspective. I imagine that is still part of your makeup? What would you like others to know about LG?

Lawrence Gellerstedt: 100% – Authenticity is my number one personal core value. In a services business, it’s easy to get caught up in trying to be everything to everyone, but I think that is a short term transactional mindset. I learned from those days ATV, and from David Cummings, to focus on “Do the Right Thing”. Between being authentic to who I am, and doing the right thing for long term relationships, I created deep and lasting ties to companies like SalesLoft, Terminus, Calendly, and WeWork. These relationships not only elevated my career quickly but gave me personal friendships that are a core part of my social fabric.

MJ: We see such tectonic shifts in commercial real estate. I think your journey illustrates perfectly how commercial real estate is evolving. Would you share a few thoughts on why you elected to leave a leadership role at Cushman & Wakefield to join WeWork?

LG: Cushman & Wakefield is a phenomenal platform. The leadership in Atlanta with John O’Neill and Tyler Courtney is rock solid. For large institutional occupiers and owners who are still operating a vast majority of their real estate via traditional long term leases, they provide a broad menu of best-in-class services.

That being said, real estate, like all industries, is experiencing disruption, and to be a part of the future of our industry, it is important to be looking at what’s next. WeWork has had a long list of issues that have been discussed at length, but I’ll challenge anyone in our industry who doesn’t acknowledge they were a catalyst for at least some fundamental change. I left Cushman to be part of the tip of the spear in leading change and not bracing for it.

MJ: What was your favorite part of the WeWork experience? You were part of a history that will be analyzed for years to come. Good and bad.

LG: I don’t mean to answer the question outside of the parameters, but I have two points to share whenever I talk about this. First and foremost, it was the people. Externally, I got to work with some of the best brokers and owners across the US. Internally, WeWork attracted a new generation of smart, driven, and, most importantly, a DIVERSE mix of people to our industry. Coming from a traditional real estate background, it was refreshing and inspiring to work with people from different backgrounds, to hear different perspectives, and be challenged on every aspect of our united approach. I’ll say this right here; it’s truly important, even today, that more women and minorities are needed in our business environment.

The second part of my answer is the experience of playing a role in an industry acceleration rarely seen. I led a team that built out space with a budget of around two hundred million dollars ($200M!) Creating these cool spaces helped us lease over 1.2M RSF of space in just two years. Even at the moment, all of us on the real estate side knew it was a Gold Rush situation. We knew the ride couldn’t last forever, but it was one incredible ride.

MJ: Your decision to walk away from WeWork was well-timed. You mentioned you could clearly see some challenges with the business model. What can you share around that?

LG: There are probably a few books worth of material here, and lots of different conjecture. From my perspective, first and foremost, WeWork had a leadership issue. No matter how smart, passionate, or capable a firm’s people are, it’s a hard thing to overcome. I do want to be clear that this wasn’t a systemic thing. We had acute challenges at the very top of the organization, and that left those of us reporting up to them in tough spots. Second, there was always a tension between the tech-focused people at the company and the real estate folks that stemmed from the external identity crisis the company was experiencing.

After the valuation jumped to over 40 billion dollars, the company needed to achieve substantial growth as a tech company to support the valuations. There are a lot of nuances here, but suffice it to say, scaling a real estate company takes significantly more time and capital, and achieving tech valuations is nearly impossible.

Even today, I know WeWork was furiously building a big part of the future of the commercial real estate industry, but when I decided to leave, I also knew what they needed from me had shifted. The company needed help on a national scale, and I wanted to focus on the Southeast where my relationships are.

MJ: I’m sure this is an exciting time for you and your crew at Southsource Advisors. What’s the mission? Why should prospective tenants and landlords call Southsource?

LG: It’s very exciting! I’ve always tried to be an agent of change within larger organizations, and now I’m finally getting to shape something. What a thrill to incorporate what I’ve learned from other roles and have no limitation. I’ve prepared for this.

Our mission is simple. To serve Atlanta based tech entrepreneurs seeking creative workspaces, and guide building owners and landlords cultivating community in their creative office projects. I think the biggest differentiator for us is that we are fine telling people when NOT to call us. We are not trying to be everything to everyone. We tell people all the time we are “t-shirts and jeans”, not suits and ties. And we mean it. We think finding what you are truly passionate about drives performance and, equally as important, drive enjoyment.

Large firms will always do well servicing the institutional side of our industry. On the other hand, many of the trends we saw pre-COVID, and the activity we are witnessing post-COVID, give our team great confidence. The changes are coming, and we are well-positioned to support our niche.

There is certainly a trend for many types of tenants to demand flexibility, and they need the creative amenities that support company culture, authenticity, and community. We help our partners focus on working with landlords that are truly committed to these things. And, obviously, vice versa. We consult with landlords needing support in adapting, implementing, and operating in the quickly changing CRE environment. It is a new era in so many ways.

MJ: My team is supporting client conversations around the acceleration of, and interest in, flexible space, changing office lease durations, and the effect this has on occupier and landlord portfolios. How are you counseling clients in this area?

LG: On both the landlord and tenant side, we are counseling folks to challenge themselves to embrace the concept of flexibility. I think short term leases in office have historically been resisted. Still, COVID has forced an unprecedented acceleration of this demand from tenants, at the same time, undermining landlords’ leverage to resist.

I think in this cycle that the capital markets will buckle, and finally allow for the underwriting of this product type. Hotels and apartments have been financeable for years on short term leases. The flexible office has more than proven an ability to generate increased NOI, in excess of what is necessary to adjust for cap rate increases and maintain value.

I also think we have to look beyond flexibility. WeWork proved that by bundling flexibility, amenities, and services, users were willing to pay more than the sum of the parts. It is important that we now unbundle all this. We simply have to identify what users want, and at the same time, encourage landlords to expand their offering to maximize value creation on both sides.

With our landlord clients, we are constantly looking at how to price flexibility, what amenities are most valued, and what services can be provided. And, who are those providers? The big opportunity here, and my team’s perspective, is that landlords can create and implement a lot of these solutions much more efficiently than third party providers. They can then expand the offering to users of all different kinds from flex to long term to in between.

For tenants, it’s simply a matter of identifying what parts of the business are stable and how far into the future, they can safely forecast and retain stability. Then move forward in securing different types of space and services to accommodate the various parts of the business and related strategies.

MJ: CORT surveyed a large portion of clients, both corporate occupiers, and commercial real estate teams. Looking at our CRE and Occupier results, is there anything that surprises you or stands out?

LG: Lots of great feedback. One thing that jumped out was the response that many employees like the option to Work From Home (WFH) and feel “more productive” at home.

These conversations always surprise me. It’s rare that companies actually measure employee productivity. Beyond that, companies are not asking what makes those employees loyal to that company. I think this is the unforeseen pitfall that will hurt companies who go too far with WFH.

Let’s say you’re a software developer or on the sales team at a really cool tech company. Your company goes WFH because you do everything on your computer/in the cloud anyway. Without considerable thought in how social ties fill an important need around experience, true problems can easily occur. Does the new work-life boil down to email, Zoom meetings, and spreadsheets? Take away the masseuse, snacks, barista, ping pong table, and nap room and replace those with your laundry room, dog, kids, neighbor, and maybe even spouse. At this point, your job becomes simply a commodity. Any software firm could hire you to do the same thing, in the same place, for just a little more money. Even setting aside the issues around tracking productivity at home, I think more threatening is the company losing its ability to retain talent outside of anything other than pay.

MJ: As you well know, my mission is to educate the commercial real estate community about the power of @CORT’s Furniture-as-a-Service model to support leasing activities in a wide variety of applications. You and Clinton McKellar, your energized partner while at CushWake, were early adopters in leveraging the access rather than ownership tactic with me long ago.

Now the FaaS approach is literally in the midst of a perfect storm as many in real estate look to conserve capital, focus on managing cash flow, flexibility, and leaving options on the table.

What are your thoughts on flexible furniture supporting tenants, space, and portfolios as we walk forward from COVID?

LG: You were such an early mover here. I think that’s why you’re a leader in this space today, and I agree, at just the right time. Honestly, when I speak to clients around their business model, I love to challenge them to go through the thought process of reducing service offerings to a passive online subscription type approach. In your world, it’s the FaaS model. Even if they can’t do it (which I think is very rare), the exercise will leave them with some interesting insights.

It’s also important to note the service model has another benefit; the product being consumed is managed. I have a great example for you. My Dad was telling me the other day that the AC in his Tesla broke, and having it repaired had been extremely difficult. On the other hand, my Mom, who leases her car, had a flat tire. The car company took care of everything ASAP. Simple.

Sure for the office, we can all go to IKEA and get what we need, but when it breaks, who wants to go back to IKEA? That trip, the interruption in the day, and putting the replacement together again isn’t included in the upfront pricing. It’s like the Total Cost of Ownership model you mentioned to me. Owning isn’t always the better deal, especially when the future is a little cloudy! Even when the service model appears more expensive, it’s often cheaper. My recommendation, in many cases, is to offload things like this to the experts. Like you and CORT!

MJ: You come from a strong family in the commercial real estate industry. Do you ever get to collaborate with your dad? What’s that like? (Sorry to reference the infamous Larry Gellerstedt as a dad, but hey, it is what it is!)

LG: We actually do get to collaborate a good bit these days. When I was at WeWork, and he was at Cousins, the dinner table conversations had lots of red tape. Now we can both speak freely, and we are even looking at some deals together. He’s got so much knowledge, not just in real estate, but in areas like strategy and leadership. He is always teaching me!

My honest answer to this question though, is, like any real relationship, where there are twists and turns. He’s my hero in so many ways, and at the same time, he’s the best at getting under my skin. And I’m sure he’d say the same about me!

The biggest question I get from other people in our industry is, “When am I going to work for him?” The answer is an easy one. “Never!”

MJ: Recently, I had a conversation with Caleb Parker from Bold. I asked him this question and love to hear your answer!

As a successful entrepreneur, what do you consider the boldest moves in your journey so far? Any tips for those of us wanting to be bolder?

LG: This is an interesting question, and again, I might stray slightly from what you intended. I think it’s really important for people like me to disown some of their boldness publicly. If someone looked at my resume, they would see a history degree, a jump to a P/R job, an unmarried co-parent jumping into business school to obtain an MBA, and then moving into a100% commission position.

They could easily think I’m a bold entrepreneur. I think I’ve made some bold choices, and I’m certainly proud of what I’ve accomplished, but if I’m viewed as walking a tightrope, I want people to know I had a net the whole time.

I started on the fifty-yard line. I think it’s my responsibility, and maybe this is my bold approach, to acknowledge my privilege and to focus less on my accomplishments and more on giving back. I want to help people that didn’t have the same advantages. I don’t think it helps to pretend that I did this all on my own, and therefore anyone can.

Instead, I want to challenge others like myself to make similar acknowledgments, and to donate time and money to enable others to get closer to where we started. Help them to grow their nets. And to the much larger audience of those not like me, I’d like to say, don’t be afraid to go for it, find allies, leverage a network, give me a call. You can compete, you are smart enough, you can succeed, and you don’t have to do it on your own. I sure didn’t.

MJ: I just finished reading through this, and I’m electing to put in the last word. LG is authentic. I will never forget his willingness to meet with me several times to listen to ideas, to meet other pioneers I introduced, contribute to ideas on how the FaaS model could better support commercial real estate. How can you read his thoughts directly above and not feel energized to succeed and give back? Bravo.

Lawrence Gellerstedt, known by most as “LG”, oversees all of Southsource’s brokerage activities and leads the company’s tech investment strategy. With a passion for building authentic and lasting relationships, LG founded Southsource in 2020 to provide a more personalized and flexible solution for both tenants and landlords in the Atlanta market.

Melanie Jones is the National Commercial Real Estate Business Development Manager at CORT. She is responsible for building awareness and sharing strategy with commercial real estate teams around access vs. ownership model called Furniture-as-a-Service. Follow Melanie on LinkedIn.